child tax credit portal for non filers

Thanks to the new IRS portal non-filers can register for the Child Tax Credit online. Bruenig alongside web designer Jon White recently created their own version of a child tax credit portal for non-filers to demonstrate how it should actually function.

June 14 2021.

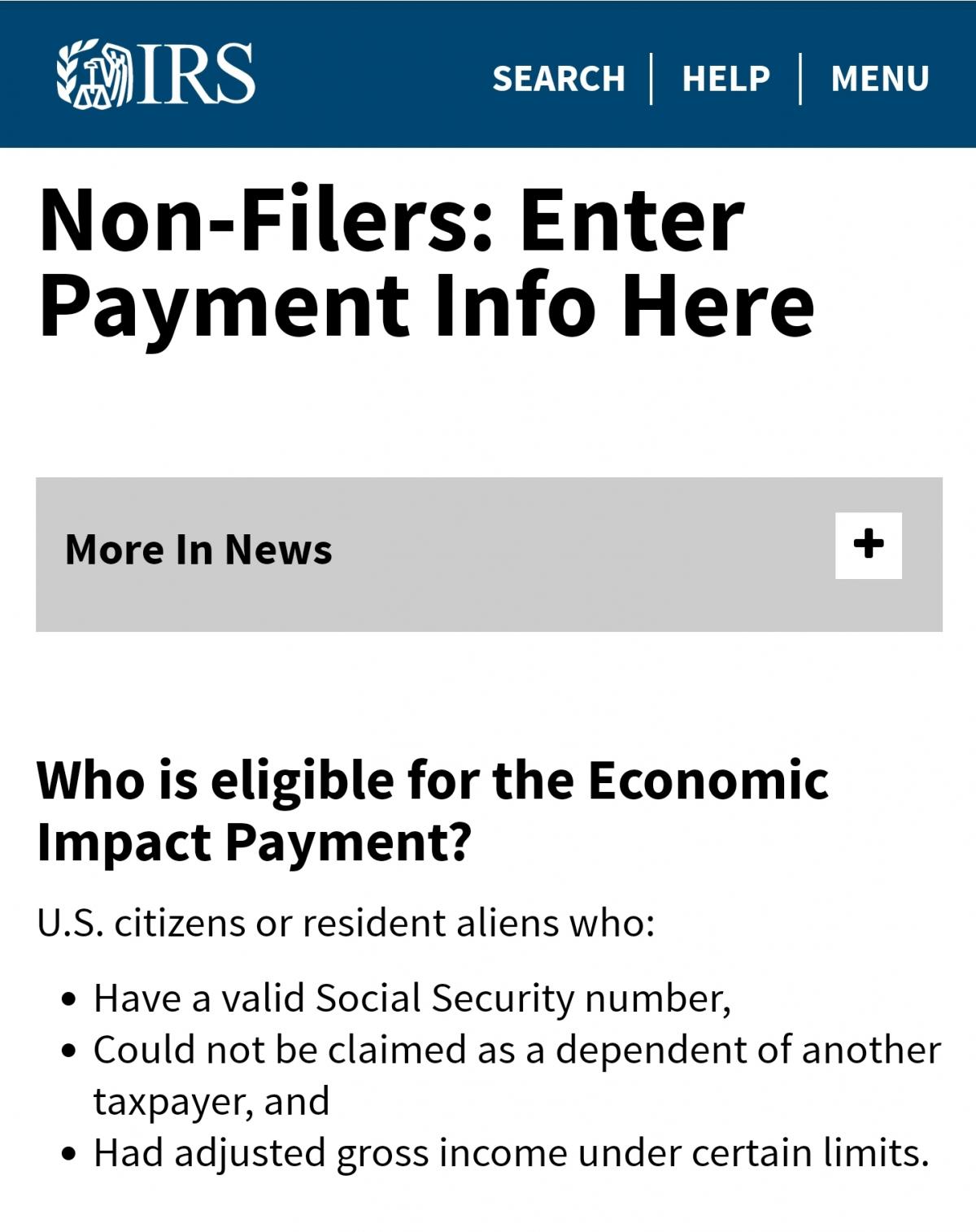

. Generally people who earn less than 12400 individually or 24800 as a couple do not have to file a tax return. See below for more information. According to the tax agency the Child Tax Credit portal was built out as an online app that allows non-filers to report basic information in order to still receive their child tax credit payments.

The Child Tax Credit helps all families succeed. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. It will be worth 3000 for children aged 6 to 17.

Most taxpayers are not required to file a return when their adjusted gross income AGI is below their applicable standard deduction amount for 2021 if not a dependent of another taxpayer 12550 for single filers or those married filing separately 25100 for those filing married filing jointly or as a qualifying widower or 18800 for heads of household with. The Child Tax Credit provides money to support American families helping them make ends meet more easily afford the costs of. The IRS Non-filer Sign-up Tool offers a free and easy way for eligible people who dont normally have to file taxes to provide the IRS the basic information needed to figure and issue advance Child Tax Credit payments.

To sign up with the IRS non-tax-filers will need to submit their. The American Rescue Plan which. Now families can sign up for this lucrative tax credit even if theyre not filing a tax return.

Httpswwwirsgovcredits-deductionschild-tax-credit-non-filer-sign-up-tool Click the blue Use the Non-filer Sign-up Tool button. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan. It also gives an additional 600 benefit for.

2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Child Tax Credit CTC Sign-up Guide for Non-filers 5 Step 1. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families.

Finally if the qualifying children you listed in a Non-Filer Tool in 2020 or 2021 are the same qualifying children you had in 2021 you probably only received half of your benefit. You can use this tool if you did not file a tax return for 2019 or 2020 and did not use the IRS Non-filers tool to. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

IRS Child Tax Credit Portal for Non-Filers Is Open for Business. Non-filers Can Use GetCTC to Get Your Child Tax Credit. You will be taken to this page.

The Internal Revenue Service announced the launch of two web portals designed for American parents to access the child tax credit Monday giving many parents just four weeks to declare their eligibility for the benefit ahead of the first of six monthly payments. 925 ET Jun 22 2021. It is also available in Spanish.

This year eligible families can use GetCTC to receive the 2021 Child Tax Credit expanded last year to 3600 per child 5 and under and 3000 per child 6 to 17. The credit is increasing to 3600 for children under the age of 6. This year eligible families can use GetCTC to receive the 2021 Child Tax Credit expanded last year to 3600 per child 5 and under and 3000 per child 6 to 17.

IRS Child Tax Credit Portal and Non-filers. The advance Child Tax Credit or CTC payments began in July 2021 and end. Fill out your tax forms Filling out this simplified tax return will help you get 2021 Child Tax Credit.

The newly and temporarily expanded Child Tax Credit provides eligible parents with a 3000 credit for every child ages. If you are eligible for the Child Tax Credit but did not get any advance payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file. However due to Treasury regulation access to these online forms through GetCTC and IRS Non-filer wasnt available until this years tax season concluded on April 18.

The new credit increases the annual benefit per child age 17 and younger to 3000 from 2000 for 2021. The Child Tax Credit Update Portal is no longer available. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online.

If you had total income in 2020 below those levels you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America. Scroll to the bottom of this IRS portal. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

The website for the IRS Non-filer Sign-up Tool is now live and will automatically determine how much your family is entitled to in the form of Child Tax Credit monthly payments. The expanded child tax credit passed in the American Rescue Plan in March will. The IRS has launched their Child Tax Credit Non-filer Sign-up Tool for taxpayers to report their qualifying children born before 2021.

Children who are 18.

Child Tax Credit What We Do Community Advocates

Treasury Irs Announce Tool To Help Non Filers Register For Child Tax Credit The Hill

Updated Irs Non Filer Tool For Claiming 2021 Advance Child Tax Credit Missing Or Under Paid Stimulus Checks Including For Dependent Payments Aving To Invest

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life In 2022

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

Child Tax Credit Charlotte Center For Legal Advocacy

Mca Ministry Corporation Nidhicompany Taxaudit Taxation Gst Incometax Incometaxindia Gstcouncil Co Chartered Accountant Tax Advisor Business Updates

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

Child Tax Credit Sign Up Tool For Non Filers King5 Com

It Took Two Days To Make A Good Ctc Website People S Policy Project

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

How Non Filers Irs Can Receive Stimulus Check City Of Miami Springs Florida Official Website